MFS Lifetime Funds – Your Defensive Approach to Retirement Savings

In my last post, I mentioned I’d be writing about a Target Date alternative that’s well-suited for those of you whose top concern is market volatility as you approach retirement. If that’s you, the MFS Lifetime Funds may be the perfect choice. They are deliberately designed to prioritize protecting your hard-earned savings as you close in on the retirement “finish line.”

The Glide Path – Designed for Your Evolving Risk Tolerance

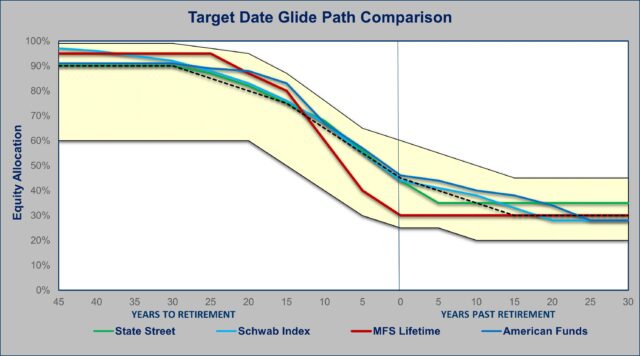

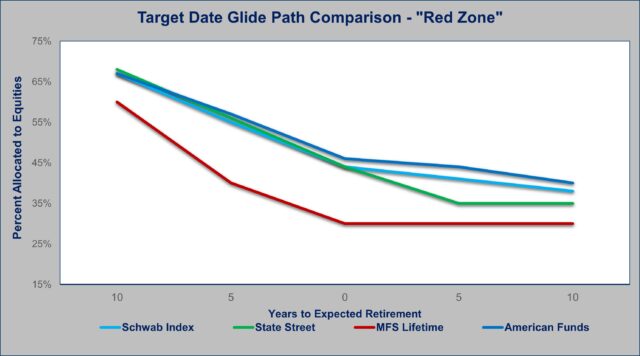

One of the biggest advantages of the MFS Lifetime Funds is their conservative positioning in the years just before and after retirement. Their unique glide path illustrates a thoughtful transition from an aggressive, growth-oriented stance early on to a defensive, risk-minimizing approach as investors get closer to retiring. It is truly one-of-a-kind, shaped more like a hockey stick than the conventional linear equity glide paths of competitor target date funds.

Picture the MFS glide path like the race strategy for a marathon runner. Early on, the approach is aggressive – going all-out to build a solid lead. But as you get closer to the finish, the strategy shifts. Now the focus is on pacing yourself, managing your effort, and avoiding any risks that could jeopardize crossing that final line successfully after all those miles.

Broad Diversification Across Sub-Asset Classes

In addition to the defensive glide path, what stands out the most to me about the MFS Lifetime Funds is their extensive sub-asset class diversification. This diversification allows the MFS Lifetime Funds to optimize their risk and return profiles at each point along the glide path based on an investor’s specific stage in the retirement investing race. In the early accumulation phase, they can truly swing for the fences by loading up on small caps, emerging markets, and other high-upside assets. As you get closer to retirement though, the mix shifts to emphasize large cap high-quality defensive equities and investment-grade debt positions designed to prioritize capital preservation.

This conservative asset allocation mix makes the MFS Lifetime Funds an excellent choice for risk-averse investors concerned about potential market volatility derailing their nest egg in the crucial pre- and post-retirement years when they are most reliant on their accumulated savings.

A Focus on Managing Risk, Not Chasing Returns

While the glide path design and wide-ranging diversification are strong foundational elements of the MFS Lifetime Funds perhaps the most important process the management team implements comes from’ their dedication to continual active risk oversight and management, especially for conservative investors.

It’s the classic “defense wins championships” mentality. The Lifetime Funds use a similar philosophy, rigorously managing risk across all their underlying funds and the total portfolio. This emphasis on capital preservation over returns-chasing, especially as investors approach retirement, truly sets these funds apart as a trusted choice for the risk-conscious saver.

The Bottom Line

While the glide path design and extensive diversification are both valuable assets, perhaps the biggest differentiator is the intense emphasis MFS places on active risk management throughout your retirement investment journey.

Their unique glide path transitions you from an aggressive offensive approach early to a disciplined, risk-focused defensive stance when it matters most. Their robust active management ensures your exposure stays on plan and avoids unnecessary risks. And their combination of experienced leadership and a deep, diversified bench allows them to seamlessly adapt their lineup to match any market “opponent.”

So, if you’re that conservative investor worried about market storms disrupting your retirement dreams after years of diligent saving and investing, give the MFS Lifetime Funds a long look. With their unique approach, you can head into your golden years confident that your nest egg will be secure, knowing that it is being protected by a true risk-management champion every step of the way.

Next up, a few words for those of you may prefer a low cost passive index approach to Target Date retirement investing.