Choosing Target Date Index Funds for the Cost-Conscious Investor

If you’re the kind of investor who values keeping costs low through passive index funds but also wants the convenience and diversification of an all-in-one Target Date fund, you’ve come to the right place. Today, we’re diving into my two favorite contenders in the Target Date index funds arena: State Street Target Retirement funds and Schwab Target Index funds.

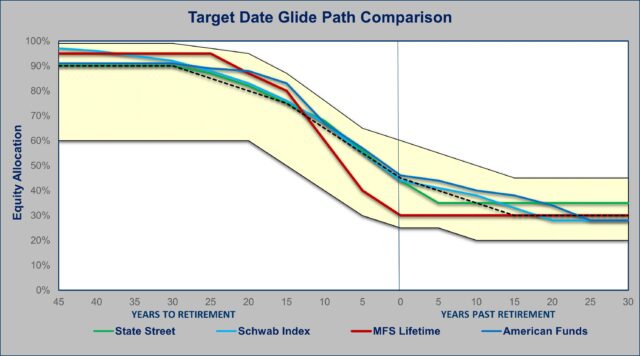

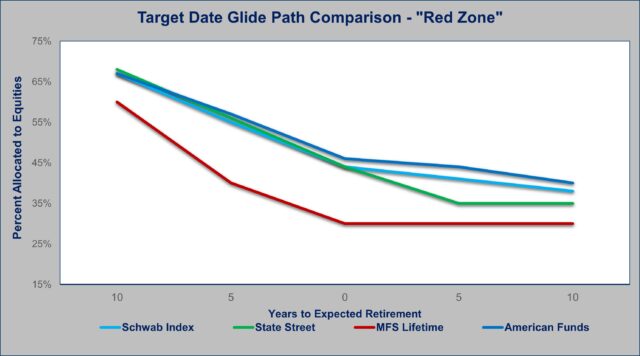

Both fund series invest in underlying passive index funds that track different asset classes like U.S. stocks, international stocks, bonds, and real assets. This gives investors broad diversification at a low cost compared to actively managed target date funds. However, they have some key differences in their glide paths and underlying fund asset class holdings that might make one a better fit for your retirement game plan.

So let’s dive in and explore these two contenders, so you can pick the right target date index fund to help meet your retirement investing needs and goals.

In This Corner: State Street Target Retirement Funds

The State Street Target Retirement funds play the long game with a “through” glidepath approach. This means they keep a relatively higher equity exposure even after the target retirement date, which can help your money last longer during retirement. Think of it like a seasoned baseball pitcher who still has some heat left in his arm well into the late innings.

For example, the State Street 2060 fund kicks off with a 90/10 mix of stocks to bonds, aiming to maximize wealth accumulation with a heavy 90% allocation to global stocks. As you approach retirement age, the fund gradually increases its fixed income and real asset holdings to reduce risk and smooth out the ride. At the retirement target date, it still keeps about 50% in equities and real estate.

Even the State Street Income fund for retirees keeps a healthy 35% in equities and real estate and 65% in bonds and other defensive assets 5 years after your retirement date. The idea is to provide income while still giving you a shot at growth opportunities. This approach recognizes that retirement is a marathon that can last 30 years or more.

State Street’s well-diversified allocations include large and small/mid U.S. stocks, international developed markets, and emerging markets. On the bond side, they mix in core investment-grade bonds, high yield, global bonds, inflation-protected TIPS, and real assets like REITs and commodities. This multi-asset strategy can help enhance overall risk-adjusted returns, much like a well-balanced sports team that excels in both offense and defense.

In The Other Corner: Schwab Target Date Index Funds

Schwab’s glidepath also uses a “through” approach, however it is even more aggressive for younger investors, starting off with a whopping 97% in global stocks. It’s like a young quarterback with a rocket arm, taking deep shots downfield to rack up yardage early on. As retirement gets closer, Schwab gradually increases fixed income to about 50% at the target date. The big difference from State Street is that it reaches the landing point of 35% equities 20 years after your retirement date.

This aggressive glidepath is designed for maximum growth potential during your long accumulation phase. Schwab’s equity allocation includes large and small U.S. stocks, developed international markets, emerging markets, and real estate (REITs), but leans more towards domestic stocks in the younger funds. On the fixed income side, you get a mix of short-term Treasuries, aggregate investment-grade bonds, and TIPS for inflation protection.

Compared to State Street, Schwab has less exposure to “real assets” like commodities and less credit risk in bonds by avoiding high yield. Schwab’s glide path and underlying funds are more plain vanilla than State Street’s multi-asset approach. While it is less diversified than State Street, it could be a good choice for young investors looking to keep fees low and focus on growth.

The Winner For You

So which of these index Target Date index funds should you choose if you are a cost conscious investor?

Here’s my take:

For Young Accumulators

The Schwab Target Index funds are a great choice if you’re in the wealth-building phase of retirement saving. Their aggressive early equity glidepath provides maximum growth potential through a low-cost, straightforward index approach. It’s a smart play to build your retirement portfolio over many years without high fees.

For 50+ Pre-Retirees and Retirees

If you’re closer to or already in retirement, the State Street Target Retirement funds are a great choice. Their well-diversified asset allocation, especially in retirement, gives you greater exposure to asset classes like small caps, real assets, and a broader mix of bonds that can enhance risk-adjusted returns and longevity.

The Choice of Target Date Index Funds is Yours

Ultimately, your choice will depend on performance, availability, costs, and your personal preferences around glidepaths and diversification. Review the details of each fund series to see what works best for your specific goals and situation.

I hope this breakdown helps you navigate the index target date fund landscape. It’s a good way to get broad market exposure and automatic rebalancing at a low cost. That being said, picking the right target date fund is about more than low costs. I believe that actively managed Target Date series can provide stronger performance, net of fees, in both good and poor financial markets, so don’t count them out. Choosing the appropriate target date fund for you is a key step towards hitting your long-term retirement goals out of the park.